Wall Street Oasis Private Equity Review – WSO PE介绍

Wall Street Oasis(WSO) 也算是商科学生常常提起的一个资料

它包含有Private Equity(PE),Hedge Fund(HF),Investment Banking(IB)以及Consulting4个面试课程

今天就来说说PE的课程的内容以及一些特点

能学到些什么

- 所有PE行业的基础知识

- PE领域常用到的LBO Modeling(相当于是必考知识)

- Case Interview

- PE面试常见问题

- 附带的Video Libarary也是包含了很多Mock Interview, Webinar, Q&A等等

- 还有包含Networking Guide,让您求职过程不再孤单和彷徨

谁有必要学

在校学生如果想进入这个领域的

已工作一些时间,现在想转行进入这个领域的

都可以花功夫学习下 如果对这一领域之前不太了解,这个确实是非常好的一个入门的材料,毕竟花几个月去搜索、打听学习,不如花1个周用个专门的材料快速充电

优惠购买

包含全套新版,如WSO Private Equity Interview Course, Networking Mastery, 以及Video Library Access等

请到官网购买

Please purchase from official website

更多内容,查看官网 Ref: www.wallstreetoasis.com/guide/private-equity-interview-prep-questions

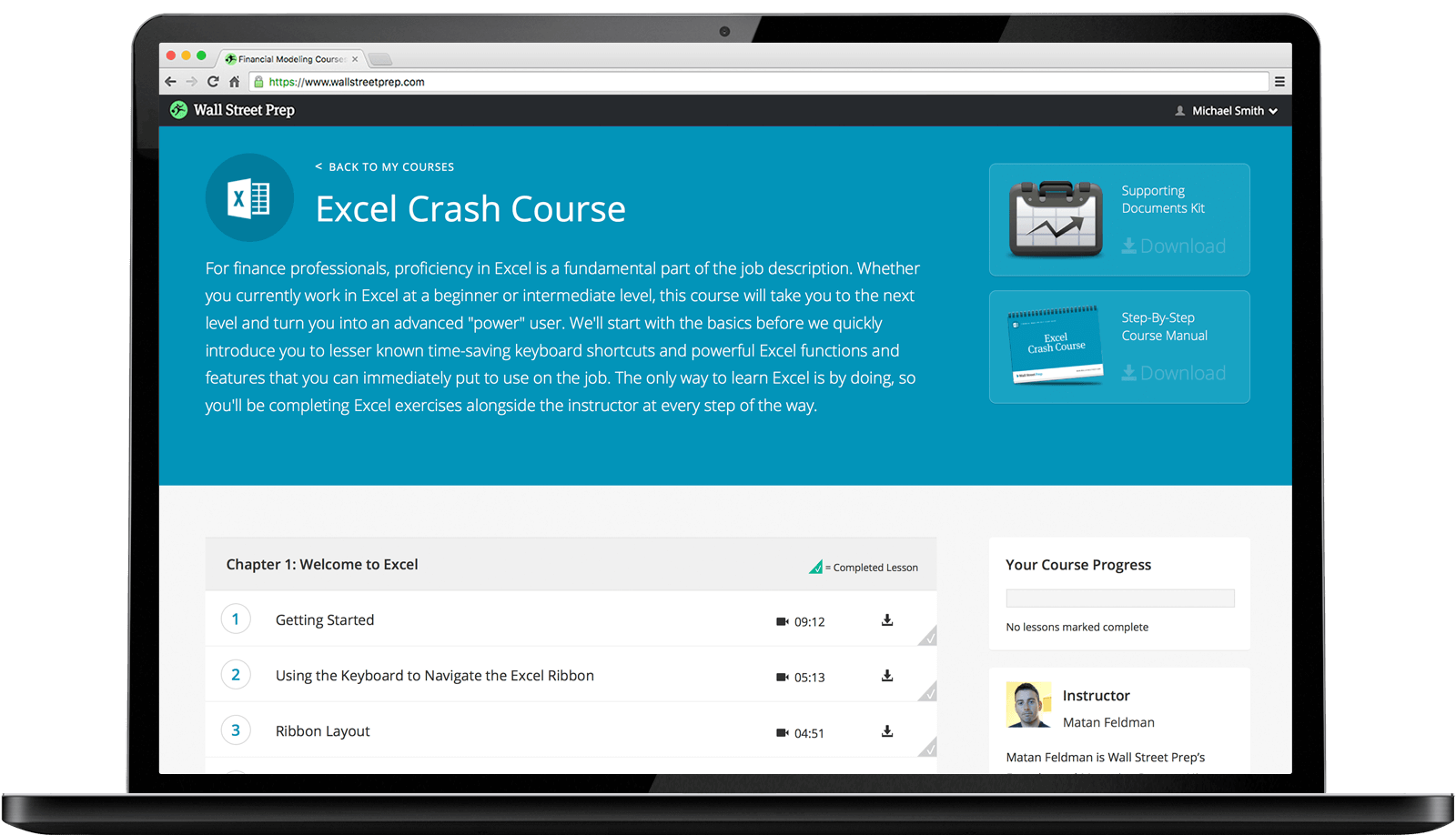

课程目录

目录摘录自学习平台

Module 1: Introduction And Overview

1.1 – Introduction

1.2 – Welcome to the PE Prep Package(03:14)

1.3 – Industry Overview

1.4 – Here’s An Easy Way to Think of Carry(01:59)

1.5 – Know This 1 Fact About PE History / For Your PE Interviews(01:31)

1.6 – Fundraising & Deal Volume

1.7 – PE Deal Types

1.8 – PE Deal Types: The 2 You Need to Know Best(01:58)

1.9 – PE Firm Types

1.10 – PE Firm Types–3 Key Takeaways for Recruiting(03:00)

1.11 – Fund Economics

1.12 – Titles, Roles and Compensation

1.13 – “Show Me the Money!” / How to Find Relevant PE Compensation Data(02:11)

Module 2: Industry Operations

2.1 – Deal Process

2.2 – The One Dirty Little Secret on Sourcing(02:52)

2.3 – 3 Actual Examples of a Teaser, NDA, and CIM(06:05)

2.4 – The Sacred Investment Committee Memo(04:38)

2.5 – Staple Financing 101: What is it and Why do Banks Offer it?(01:51)

2.6 – 3 Material Adverse Changes (MACs) to Watch Out For(02:10)

2.7 – Deal Selection

2.8 – The 7 Traits of The Perfect Deal and… One That Is More Important than All of Them Combined(04:43)

2.9 – Deal Funnel and Lifecycle

2.10 – Common Diligence Topics

2.11 – Common Due Diligence–Why Does it Matter?(03:06)

2.12 – How PE Makes Money

2.13 – Bonus Webinar: Sources of Value Creation in Private Equity(39:37)

2.14 – What is the True Driver of Returns? Financial Engineering vs Operational Improvement(01:44)

Module 3: Recruiting Overview

3.1 – Common PE Career Paths

3.2 – 5 Examples of Where People Go After Their PE Career is Over(03:22)

3.3 – How to Build a PE Background

3.4 – Big Fish in Small Pond or Swim with the Sharks?(02:28)

3.5 – What firms and groups give you the best shot at PE?(02:17)

3.6 – Bonus Webinar: Private Equity Success Story from a Non-target Engineering Major(01:05:35)

3.7 – PE Business Development Roles – Another Way to Break In(47:12)

3.8 – Recruiting Cycle

3.9 – PE Recruiting Timing: Game Theory In Action(01:42)

3.10 – How to Work with Recruiters

3.11 – 3 Crucial Tips When Dealing with PE Recruiters/Headhunters(02:37)

3.12 – How to Choose an Offer

3.13 – 3 Ways to Find the Dirt and Get a Good Grasp of Private Equity Firms(02:43)

3.14 – Bonus Webinar: PE Recruiting Process in Detail(54:47)

3.15 – How to Write Your Resume

3.16 – Resume Prep for Private Equity Interviews(55:15)

3.17 – 5 Common Mistakes on PE Resumes that Can Hurt You(04:44)

Module 4: Interview Preparation

4.1 – Interview Process

4.2 – Why LBOs Use Leverage and 3 Other Ways to Boost Returns(02:04)

4.3 – 3 Financial Statements

4.4 – Why You Should Care About Changes in Net Working Capital(02:30)

4.5 – Capital Structure

4.6 – 4 Capital Structure Tiers to Know Well(04:47)

4.7 – Common Valuation Techniques

4.8 – Common Calculations

4.9 – How Would You Calculate a Firms WACC and How Would You Use it?(07:20)

4.10 – “Walk Me Through a DCF”(04:21)

4.11 – Here is How You Do IRR Quickly in Your Head(01:11)

Module 5: Interview Questions

5.1 – Top 30 Technical Questions & Answers

5.2 – Sample Deal Walk Through, One Good, One Bad(06:42)

5.3 – Bonus Webinar: How to Speak About Your Investment Banking Deals In a Private Equity Interview(01:03:07)

5.4 – How to Prep for a PE Megafund Interview(55:34)

5.5 – What if you can’t value a company using DCF or multiples?(02:58)

5.6 – Why You Should Care About Changes in Net Working Capital (Repeat)(02:30)

5.7 – Bonus Webinar: PE Investment Case Presentation and How The Deal Process Works(49:20)

5.8 – DCF vs. Trading Multiples vs. Transaction Multiples… Which provides the Highest Valuations?(03:07)

5.9 – The 7 Traits of The Perfect Deal and… One That Is More Important Than All of Them Combined (Repeat)(04:43)

5.10 – Top 15 Fit Questions & Answers

5.11 – PE Firms Get Jealous Too: Here is Proof(02:18)

5.12 – Bonus Webinar: Transition from Investment Banking to Private Equity(01:08:00)

5.13 – Top 10 Brainteaser Questions & Answers

5.14 – Follow These 5 Steps if You Get Stuck on a Brainteaser(01:46)

Module 6: LBO Modeling

6.1 – Introduction to LBO Modeling Tests

6.2 – The Paper LBO

6.3 – Paper LBO Example 1(27:21)

6.4 – The Basic (1-Hour) LBO

6.5 – Basic LBO Example 1(01:28:54)

6.6 – Final Thoughts on LBO Modeling Tests

Module 7: Private Equity Cases

7.1 – Private Equity Case – Paysmart(49:32)

7.2 – Private Equity Case – Oilfield Services(51:22)

7.3 – Private Equity Case – Transnational M&A(54:59)

7.4 – Private Equity Case – Creating Value Through Operational Change – Apparel Industry(59:58)

Module 8: Appendix

8.1 – Paper LBO Example 2(26:04)

8.2 – Paper LBO Example 3(27:17)

8.3 – Basic LBO Example 2(01:19:33)

8.4 – Basic LBO Example 3(45:20)

8.5 – Full LBO Example 1(01:30:17)

8.6 – Full LBO Example 2(04:27:29)

8.7 – Common Terms Glossary

福贝壳儿 » Wall Street Oasis Private Equity Review – WSO PE介绍