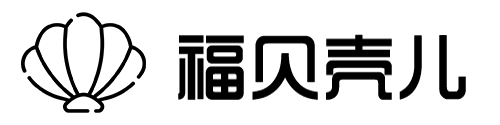

LBO Modeling(Wall Street Prep) 介绍

内容介绍

LBO Modeling是Wall Street Prep 中专注于介绍LBO的课程,是Premium Package的其中一个部分

杠杆收购(LBO)模型被投资银行和私募股权公司广泛使用,通常是财务面试的一部分。在本课程中,您将学习如何从头开始建立一个真实、复杂的LBO模型。 您将从学习基本的LBO概念、典型的交易结构和当前的行业动态开始。然后,您将开始逐步建立模型,涵盖建立收购模型时出现的最常见和最具挑战性的问题。课程最后将进行敏感性和情景分析,以及如何建立输出表,这是任何专业级LBO分析的关键。

因为LBO的使用非常广泛,所以官方也单独提供LBO的购买

如果需要Premium Package全套或者对多个Modeling课程都有学习计划,还是建议大家直接购买Premium Package,还附赠了36个Bonus课程

快捷链接:https://www.forbanker.com/wall-street-prep-review-premium-package/

The LBO Modeling program included in the Premium Package is now available as a stand-alone course. Designed for investment banking and private equity professionals who want to take their LBO modeling skills to the next level.

LBO课程是想进入Investment Banking,特别是Private Equity领域必会的一个知识点,强烈建议这部分童鞋熟练掌握

能学到什么

- Learn how an LBO / Recapitalization works given today’s benchmarks and credit environment

- Develop an “industrial strength” LBO model driven off a fully integrated 3 statement model

- Integrate switches for LBO vs. Recap accounting treatment

- Toggle between tax and valuation implications of asset deals, (338(h)(10) election, and stock sale

- Learn best practices for modeling Senior, Revolver, Sub, Mezzanine and Preferred stock

- Add a PIK toggle to various debt tranches

- Integrate cash sweep functionality into term loan debt tranches

- Build the Sources & Uses (S&U) schedule – the correct way

- Analyze & sensitize IRRs for sponsors, management, preferreds, and mezzanine

- Modeling complex accounting adjustments including deferred taxes, fair value write ups, and goodwill

- Attach a DCF valuation to your LBO

- Use as a reference to get ahead on the job and in your career

- Gain the confidence to ace your private equity interviews

课程目录

购买

请到官网购买

Please purchase from official website