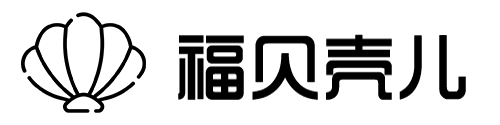

The 13-Week Cash Flow Model(Wall Street Prep) 内容介绍

内容介绍

Learn how to build an Integrated 13-week cash flow model step-by-step.

为什么要学这个课程

- Complete 13-Week Cash Flow (TWCF) Training: This course is a step-by-step buildup of a fully integrated 13-week cash flow model in the context of a turnaround and financial restructuring.

- Not Just Concepts – Real World Modeling: Using a case study, you will build a fully-integrated model as you would on the job. This is the only course available that teaches complex model mechanics for a 13-week cash flow model while weaving the motivations of the various stakeholders during both in court or out of court turnarounds.

能学到什么

- Integrated 13-Week Cash Flow Modeling

- Working Capital & Other Rollforwards

- Borrowing Base & Revolver/DIP Modeling

- Reconciling EBITDA to the 13-Week Cash Flow

- Case Manager and Multiple Scenarios

- Converting Monthly to Weekly Forecasts

- General Ledger Accounting Mapping Best Practices

课程目录

INTRODUCTION TO THE TWCF

1Introduction to the TWCF5:56

2TWCF as a decision making tool4:40

3An example of a TWCF AHP4:58

4Non-operating disbursements2:03

5Lyondell’s TWCF6:22

AMERICAN HOME PRODUCTS CASE STUDY

6AHP case study introduction6:08

7AHP Case Study: 363 sale “Stalking Horse Bidder”3:09

8AHP case study: Credit bidding3:53

9AHP Case Study: The role of the TWCF4:42

INTRODUCTION TO TWCF MODELING

10Introduction to TWCF modeling3:50

11Introducing the TWCF model case study4:25

12Catalyst for distress2:29

13Getting organized with the TWCF4:23

14TWCF model architecture2:41

15Company information provided3:52

TWCF MODELING STEP-BY-STEP

16Modeling 30000 foot view3:20

17AR rollforward15:56

18Modeling disbursements6:19

19AR rollforward complete5:02

20Non-receivables receipts6:09

21Forecasting empoyee wages2:55

22Payroll Excel solution2:02

23Wages payable rollforward 12:34

24Wages payable rollforward 22:43

25Inventory rollforward intro4:11

26DOH and inventory turnover3:18

27Interpreting inventory KPIs1:09

28Building the inventory rollforward10:27

29Accounts payable rollforward intro1:14

30DPO calculation and KPI discussion2:27

31Building the AP rollforward3:01

32Forecasting inventory disbursements3:22

33Rent utilities other disbursements1:26

34Modeling other disbursements2:59

35Modeling non-operating disbursements3:40

36Capital expenditures1:12

37Professional fees 12:13

38Professional fees 20:54

39Interest payable and debt rollforwards5:04

40Completing the pre-revolver TWCF6:21

BORROWING BASE AND REVOLVER

41Borrowing base modeling8:32

42Borrowing base solutions4:10

43Revolver mechanics4:59

44Modeling the revolver12:23

45Modeling revolver interest6:56

46Avoiding a circularity2:49

EBITDA RECONCILIATION

47EBITDA reconciliation5:01

48Modeling EBITDA to cash flows 14:55

49Modeling EBITDA to cash flows 23:42

CASE MANAGER AND SENSITIVITY

50Building a case manager into a TWCF8:15

51Integrating cases into the TWCF9:38

52Sensitizing individual drivers3:17

ADDING MODEL COMPLEXITY

53Most common TWCF complexities0:55

54Working with messy data2:34

55Commingled line items2:43

56Forecasting a Messy Monthly IS 15:42

57Forecasting a Messy Monthly IS 25:54

58Forecasting a Messy Monthly IS 32:00

59Converting Monthly Data to Weekly 113:14

60Converting Monthly Data to Weekly 213:29

61Remodeling: Updating TWCF for new weeks9:14

ACCOUNT MAPPING USING SUMIFS

62Account mapping3:39

63Using UNIQUE to map accounts5:37

购买

原链接(Purchase Link)

www.wallstreetprep.com/self-study-programs/13-week-cash-flow-model/

希望看到这里的童鞋们:事事如意,(面试)试试如意!

有任何疑问可添加微信号(扫码添加):

美东时间作息时间回复

福贝壳儿 » The 13-Week Cash Flow Model(Wall Street Prep) 内容介绍

福贝壳儿 » The 13-Week Cash Flow Model(Wall Street Prep) 内容介绍