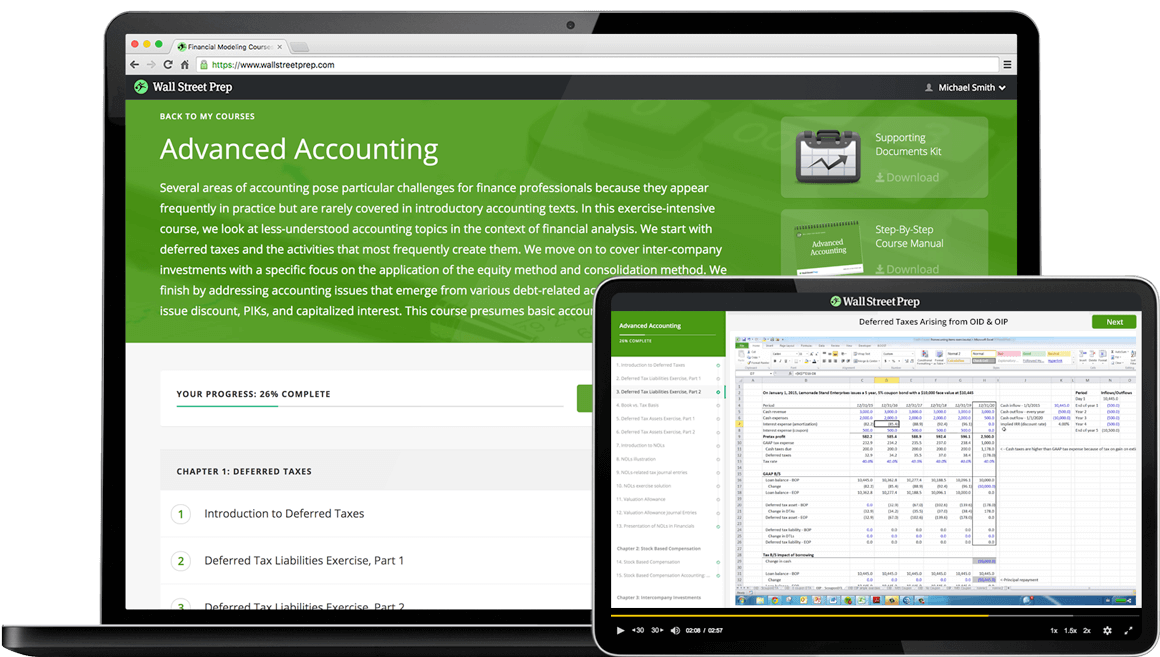

Master accounting topics that pose a particular challenge to finance professionals. Includes 6+ hours of step-by-step video instruction filled with real world exercises.

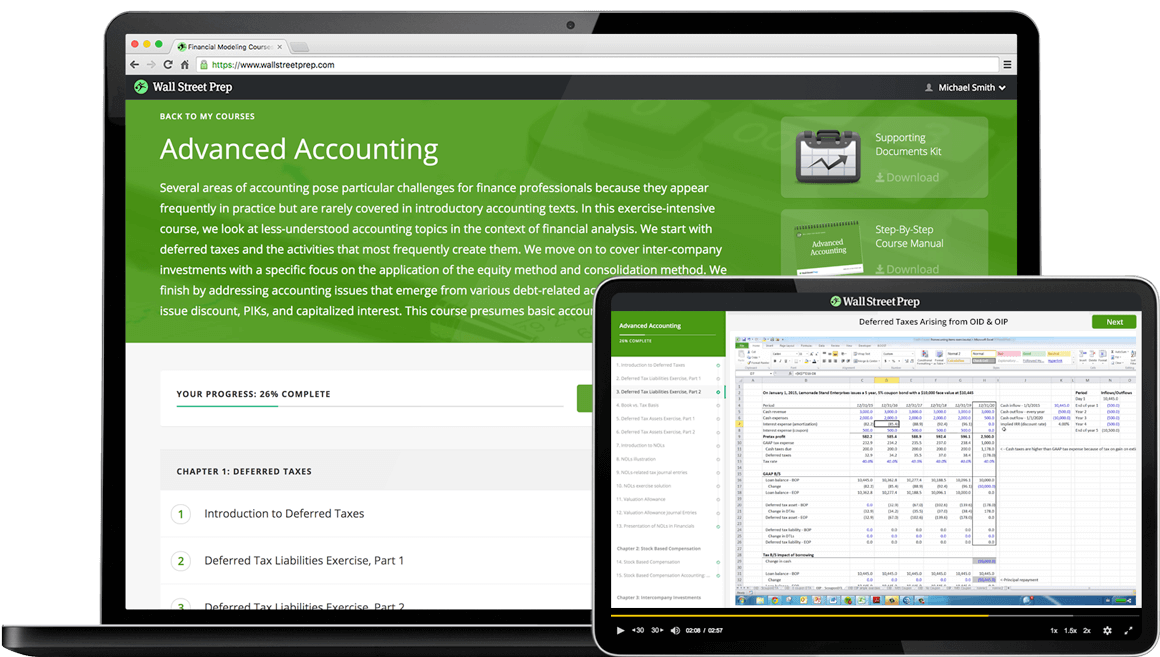

Several areas of accounting pose particular challenges for finance professionals because they appear frequently in practice but are rarely covered in introductory accounting texts. In this exercise-intensive course, we look at less-understood accounting topics in the context of financial analysis. We start with how financial statements are adjusted by companies and analysts to show “non-GAAP” results. Next, we cover deferred taxes and the activities that most frequently create them. We move on to cover inter-company investments with a specific focus on the application of the equity method and consolidation method. We finish by addressing accounting issues that emerge from various debt-related activities such as original issue discount, PIKs, and capitalized interest. This course presumes basic accounting knowledge.

有几个会计领域对财务专业人员构成了特殊的挑战,因为它们在实践中经常出现,但在会计入门课本中却很少涉及。在这门练习密集型课程中,我们将在财务分析的背景下探讨不太理解的会计主题。我们从公司和分析师如何调整财务报表以显示 “非GAAP “结果开始。接下来,我们将介绍递延税款和最经常产生递延税款的活动。我们接着介绍公司间的投资,并特别关注权益法和合并法的应用。最后,我们将讨论各种债务相关活动中出现的会计问题,如原始发行折扣、PIK和资本化利息。本课程以具备基本会计知识为前提。

This course is designed for professionals and those pursing a career in the following finance careers:

-Investment Banking

-Buy-Side Equity Research

-Sell-Side Equity Research

-Private Equity

-Credit Research

-FP&A and Corporate Finance

Chapter 1: Deferred Taxes

1 Introduction to Deferred Taxes 8:26

2 Deferred Tax Liabilities Exercise, Part 1 10:54

3 Deferred Tax Liabilities Exercise, Part 2 3:08

4 Book vs. Tax Basis 1:55

5 Deferred Tax Assets Exercise, Part 1 11:07

6 Deferred Tax Assets Exercise, Part 2 2:39

7 Introduction to NOLs 2:44

9 NOLs-related tax journal entries 1:53

10 NOLs exercise solution 7:43

11 Valuation Allowance 4:46

12 Valuation Allowance Journal Entries 3:21

13 Presentation of NOLs in Financials 1:12

Chapter 2: Stock Based Compensation

14 Stock Based Compensation 5:05

15 Stock Based Compensation Accounting: Journal Entries Reading

Chapter 3: Intercompany Investments

16 Introduction to Intercompany Investments 7:16

17 Trading, Available for Sale & Held to Maturity Securities 6:55

18 Equity Method, Part 1 5:52

19 Equity Method, Part 2 6:37

20 Deferred Taxes & Dividends Received Deductions Arising From Equity Investments 13:39

21 Paying in Excess of Book Value Under Equity Method 6:34

22 Paying in Excess of BV Exercise 9:45

23 Consolidation Method & Noncontrolling Interests, Part 1 7:48

24 Consolidation Method & Noncontrolling Interests, Part 2 10:48

25 Consolidation Method & Paying in Excess of BV 14:48

Chapter 4: Debt Accounting; PIK; Capitalized Interest; OID & OIP

26 Introduction & PIK Debt 5:44

27 Capitalized Interest 3:21

28 Original Issue Discount 4:34

29 OID Zero Coupon Exercise 6:29

30 OID With Coupon Exercise 4:41

31 OIP With Coupon Exercise 3:43

32 Debt Accounting: Financing Fees Reading

33 Deferred Taxes Arising from OID & OIP 3:21

34 Deferred Taxes Arising from OID & OIP, Exercise 1 14:29

35 Deferred Taxes Arising from OID & OIP, Exercise 2 4:17

36 Deferred Taxes Arising from OID & OIP, Exercise 3 4:58

Chapter 5: Lease Accounting

37 Introduction to Lease Accounting 2:22

38 Lease accounting IFRS vs. US GAAP 4:44

39 Lease Presentation on the Balance Sheet 5:30

40 Operating Lease Accounting Overview 2:49

41 Exercise: Straight-Line Rent Expense 3:34

42 Exercise: ROU and Lease Liability Initial Entries 4:08

44 ROU Depreciation Amortization 5:59

45 Lease Liability Accounting 3:32

46 ROU Asset and Lease Liability Roll-Forward 5:15

47 Operating Lease Journal Entries 2:02

48 Finance vs Operating Lease Classification 2:38

49 Finance Lease Accounting 5:00

50 Finance Lease Roll Forwards 3:30

51 Lease Footnote Disclosures 3:22

52 Cash Flow Statement Leases Presentation 4:56

53 Lease Accounting Summary 2:36

Chapter 6: Lease Accounting Nuances

54 Impact of Lease Commencement Payment 6:18

55 Lease Liability Rollforward Walk Though 4:42

56 ROU Exercise: Operating Leases 2:24

57 ROU Exercise: Operating Leases Walk Through 1:13

58 Exercise: Finance Leases 3:11

Chapter 7: Stock Sale v Asset Sale

59 Stock Sale v. Asset Sale Intro 2:43

60 Tax Basis Step Ups in Stock sale vs Asset sale 5:34

61 Quantifying PV of Acquirer Tax Benefits in Tax Basis Step Up 4:58

62 Seller Preferences in M&A Deal Structuring 3:51

63 Calculating Target Proceeds in M&A in Asset vs. Stock Sale 9:54

64 Taxable Sales: Introduction and Acquirer Perspective 3:15

65 Taxable Sales including 338(h)(10): Target Perspective 3:07

67 NOLS in M&A exercise 6:48

68 NOLs for 80%+ owned subsidiaries 1:21

69 Selling S-Corporations and subsidiaries 2:09

70 Aggregate Deemed Sales Price (ADSP) 1:56

71 Taxable Sales Exercise 11:28