本课程是循序渐进的教学课程,专为从事固定收益研究、投资、销售和交易或投资银行(债务资本市场)的人员设计。

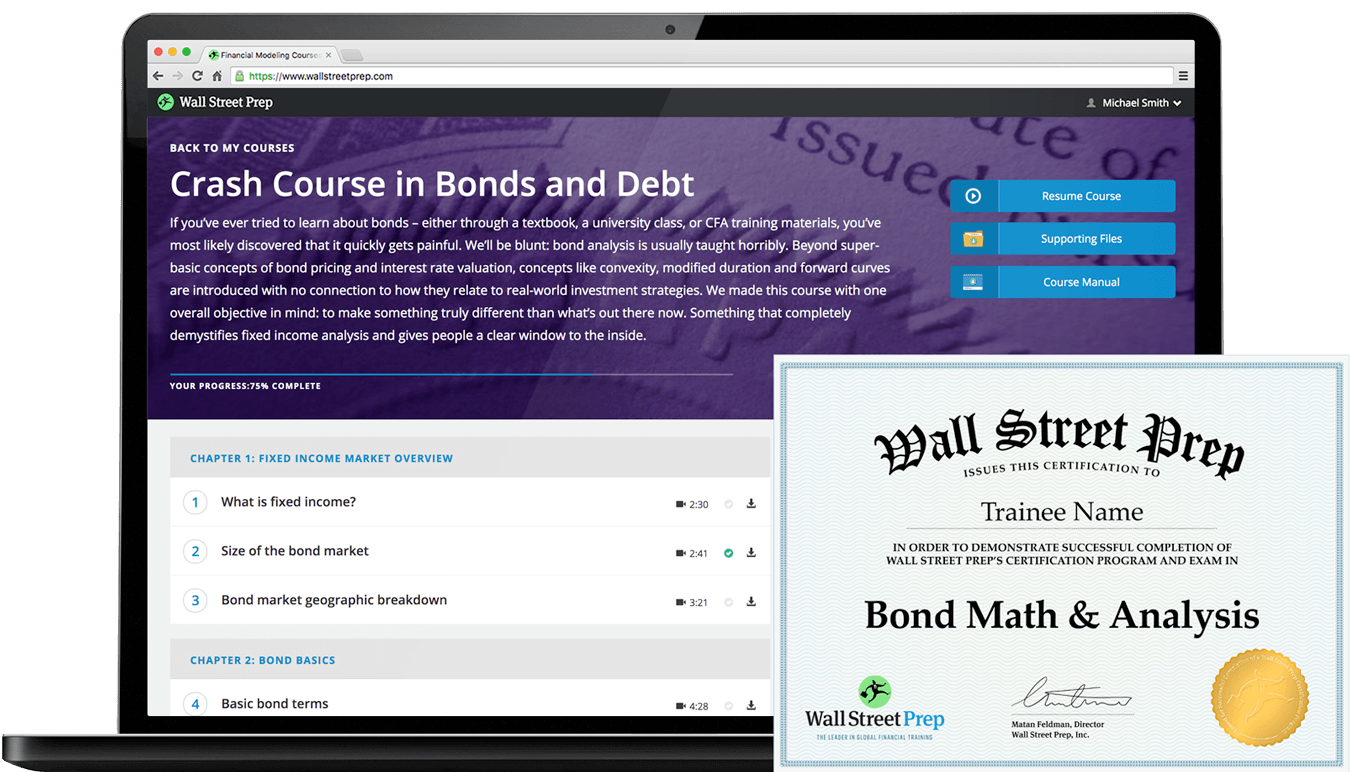

A step-by-step course designed for those pursuing a career in fixed income research, investments, sales and trading or investment banking (debt capital markets).

内容介绍

This course will teach you all about bonds. First, we’ll take a look at the role of bonds in financing governments, corporations, households and financial institutions around the world. Next, we’ll dive into bond math. You’ll learn the various calculations and concepts required to accurately analyze the large variety of fixed income products. We’ll start slow, but will quickly build up to some of the most traditionally confusing bond concepts: convexity, duration, spot rates, forward rates and the drivers of changes to the all-important yield curve. We conclude with a discussion of credit analysis and an overview of debt capital markets. Enjoy the course!

本课程将教你所有关于债券的知识。首先,我们将看看债券在为世界各地的政府、企业、家庭和金融机构融资方面的作用。接下来,我们将深入了解债券数学。您将学习准确分析种类繁多的固定收益产品所需的各种计算和概念。我们将从慢速开始,但会迅速建立起一些传统上最令人困惑的债券概念:凸性、存续期、即期利率、远期利率以及最重要的收益率曲线变化的驱动因素。最后,我们将讨论信用分析和债务资本市场的概述。祝您课程愉快

可学到内容

Fixed income market overview

Bond math basics

Yield calculations and conventions

Money Market math

Interest rate risk

Real world bond pricing nuances

Callable bonds

The yield curve

Nominal spread & Z-spread

OAS

Spot rates

Realized compound yield

Holding period yield

Forward rates

Credit analysis

Debt Capital Markets

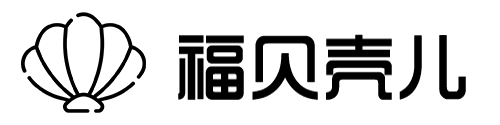

课程目录

Chapter 1: Fixed income market overview

1 What is fixed income? 2:30

2 Size of the bond market 2:41

3 Bond market geographic breakdown 3:21

Chapter 2: Bond basics

6 Using Excel’s RATE() function 5:00

7 Reinvestment assumption of YTM 3:26

8 YTM vs. current vs. nominal yield 2:16

10 Bond price as present value of a bond’s cash flows 1:32

11 Simple bond price exercise 2:47

13 Bond issuance costs 2:53

14 The price/yield relationship 3:52

15 Primary vs. secondary bond market 4:28

16 The bid/ask spread 2:44

Chapter 3: Yield calculations and conventions

17 Coupon frequency and bond equivalent yield (BEY) 3:14

18 BEY vs Effective annual yield (EAY) 6:45

19 Converting from BEY to EAY 4:14

20 Compounding conventions of 0-coupon bonds 7:41

Chapter 4: The money market math

21 Money market yield 8:04

22 Money market math exercises 5:08

25 Converting interest rates 5:49

26 Money market instruments 3:26

Chapter 5: Real world bond pricing nuances

28 Bond pricing between coupons 1:29

29 Fractional periods 7:01

30 Day count convention 1:51

32 Dirty price exercise 6:15

33 Clean vs dirty price 4:08

34 Useful Excel functions 2:55

35 Bond pricing exercise, part 1 6:34

36 Bond pricing exercise, part 2 8:25

37 Bond pricing exercise, part 3 4:51

38 Interpreting the Bloomberg bond screen 6:43

Chapter 6: Realized compound yield and holding period yield

39 Realized compound yield and holding period yield 2:55

40 RCY / HPY exercise, part 1 6:07

41 RCY / HPY exercise, part 2 2:34

42 RCY / HPY exercise, part 3 19:48

Chapter 7: Interest rate risk

43 Intro to interest rate risk 4:27

45 Hedging interest rate risk 6:15

46 Estimating the price impact of rate changes 2:50

47 Modified duration & dollar duration 4:39

48 Modified duration exercise 5:59

49 Useful Excel functions for interest rate risk 1:48

50 Modified duration exercise, part 2 6:31

51 Modified duration exercise, part 3 3:54

53 Convexity exercise 13:35

54 How convexity is applied in practice 2:29

55 Duration/convexity between coupons 3:01

56 Duration/convexity between coupons exercise 8:33

57 Interpreting the Bloomberg YAS screen 10:16

Chapter 8: Callable bonds

59 Make whole call, Apple example 3:17

61 Sinking fund redemption 2:59

62 Yield to call and yield to worst 5:54

Chapter 9: The Yield Curve

63 Yield curve intro 4:57

64 Term structure theory 11:31

65 Monetary policy intro 6:03

66 Federal funds and the discount rate 3:13

67 Open market operations 3:03

68 Other central bank tools 6:07

69 Summary of forces affecting the yield curve 8:09

70 Yield curve shape at various points in the business cycle 10:02

Chapter 10: Spot rates

72 Spot rates role in bond valuation 9:56

73 Full vs YTM bond valuation approaches 6:56

74 Bootstrapping the spot curve, part 1 11:18

75 Bootstrapping the spot curve, part 2 13:47

Chapter 11: Z-spread and OAS

76 Yield spreads and the z-spread 16:30

77 Option adjusted spread 4:10

Chapter 12: Forward rates

79 Forward rate exercise, part 1 7:10

80 Forward rate exercise, part 2 9:18

81 Trading strategy using forward rates 10:57

Chapter 13: Credit analysis

84 Navigating Clear Channel’s bond agreement 8:54

购买

请到官网购买

Please purchase from official website

课程原链接www.wallstreetprep.com/self-study-programs/crash-course-in-bonds/

福贝壳儿 https://www.forbanker.com

希望看到这里的童鞋们:事事如意,(面试)试试如意!

有任何疑问可添加微信号(扫码添加):

美东时间作息时间回复

福贝壳儿 »

Crash Course in Bonds and Debt(Wall Street Prep) 内容介绍