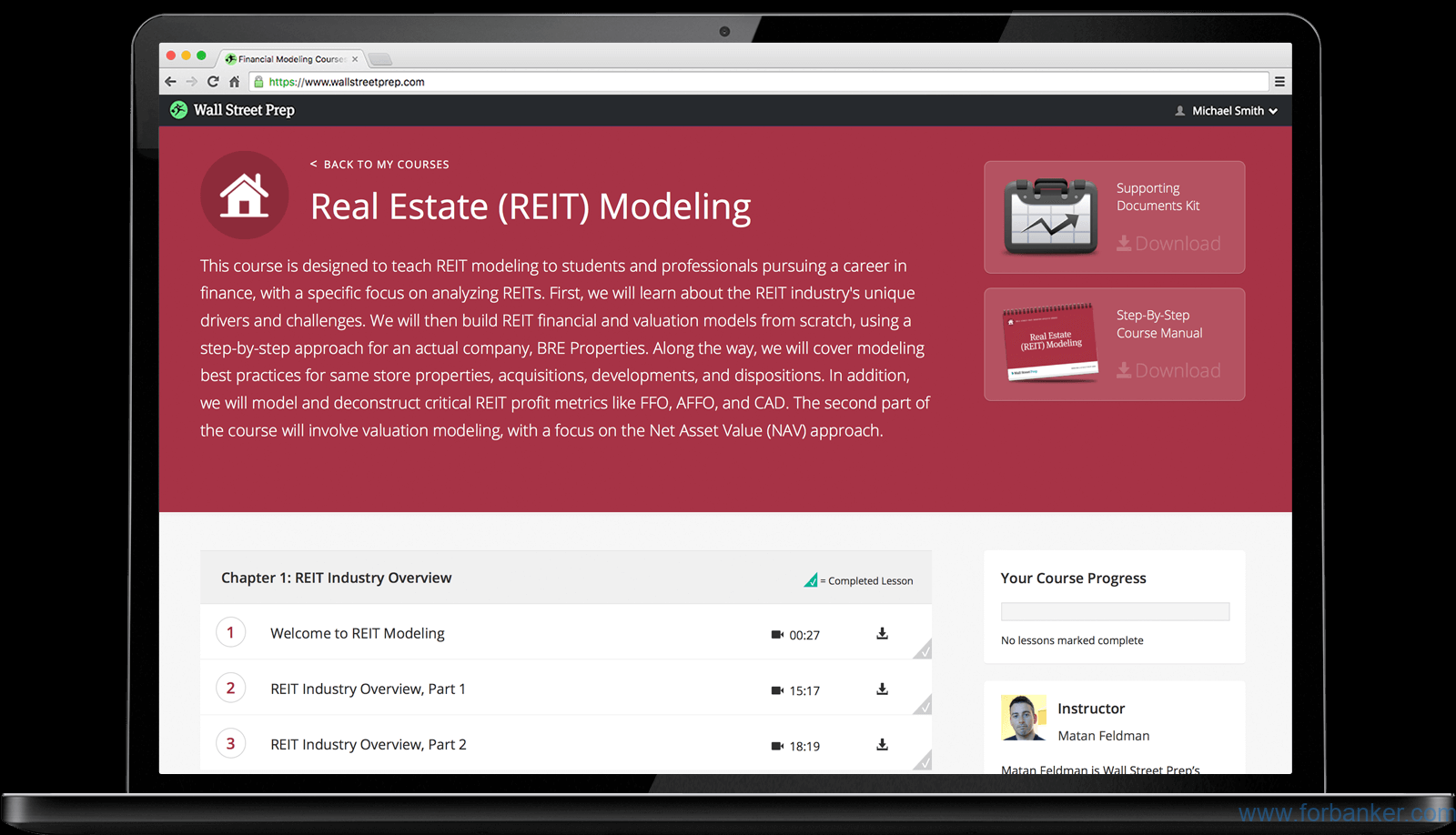

REIT Modeling(房地产信托投资)对于希望进入地产投资类的基金、投行工作的求职有极大的帮助,提供有Valuation Modeling,学完后,可以了解到 各种常见的model,地产领域的各种基础知识、地产开发的头头道道等

This course is designed to teach REIT modeling to students and professionals pursuing a career in finance, with a specific focus on analyzing REITs. First, we will learn about the REIT industry’s unique drivers and challenges. We will then build REIT financial and valuation models from scratch, using a step-by-step approach for an actual company, BRE Properties. Along the way, we will cover modeling best practices for same store properties, acquisitions, developments, and dispositions. In addition, we will model and deconstruct critical REIT profit metrics like FFO, AFFO, and CAD. The second part of the course will involve valuation modeling, with a focus on the Net Asset Value (NAV) approach.

CHAPTER 1: REIT INDUSTRY OVERVIEW

1Welcome to REIT Modeling0:27

2REIT Industry Overview, Part 115:17

3REIT Industry Overview, Part 218:19

CHAPTER 2: MODELING A REIT’S INCOME STATEMENT

4Modeling the Income Statement, Part 19:15

5Modeling the Income Statement, Part 216:38

6Modeling the Income Statement, Part 36:03

CHAPTER 3: UNDERSTANDING & MODELING REIT’S SEGMENTS

7REIT Segments: Same Store Sales, Part 110:42

8REIT Segments: Same Store Sales, Part 211:12

9REIT Segments: Same Store Expenses and NOI6:51

10REIT Segments: Lease Ups, Renovations & Acquisitions13:58

11REIT Segments: Dispositions & Discontinued Ops, Part 18:29

12REIT Segments: Dispositions & Discontinued Ops, Part 24:12

13Modeling Segments: Same Store Properties21:32

14Modeling Segments: Acquisitions8:32

15Modeling Segments: Dispositions14:35

16Modeling Segments: Discontinued Ops and Dispositions Cleanup9:08

17Modeling Segments: Development1:54

CHAPTER 4: ANCILLARY INCOME & NON-OPERATING ITEMS

18Modeling Ancillary and Other Income11:18

19Modeling Non-Operating Income and Finishing the Income Statement15:47

CHAPTER 5: UNDERSTANDING THE REIT BALANCE SHEET

20Understanding the Balance Sheet: Assets and A/P16:07

21Understanding the Balance Sheet: Non-Debt Liabilities19:55

22Understanding the Balance Sheet: Debt7:02

CHAPTER 6:MODELING THE REIT BALANCE SHEET

23Modeling Real Estate Assets15:51

24Modeling CIP and Accum. Depreciation11:28

25Modeling Other Assets3:04

26Modeling Non-Debt Liabilities and Equity11:31

27Modeling Non-Revolver Debt4:51

28Balance Sheet Cleanup5:10

CHAPTER 7: CASH FLOW STATEMENT & MODEL CLEANUP

29Understanding the Cash Flow Statement17:09

30Modeling the Cash Flow Statement18:43

31Pre-Revolver Model Cleanup2:37

CHAPTER 8: THE REVOLVER, INTEREST EXPENSE & CIRCULARITY

32Understanding the Revolver9:40

33Modeling the Revolver9:43

34Understanding Interest Expense8:43

35Modeling Interest Expense18:52

36Understanding Circularity5:10

37Handling Circularity in a Model5:16

CHAPTER 9: MODELING FUTURE DEVELOPMENTS

38Understanding a REIT’s Developments12:37

39Modeling Developments, Part 111:24

40Modeling Developments, Part 211:43

41Modeling Developments, Part 3 & Finishing the Model9:09

CHAPTER 10: FUNDS FROM OPERATIONS (FFO) & CAD

42Understanding EBITDA, FFO and CAD9:18

43Modeling EBITDA, FFO and CAD18:15

CHAPTER 11: REIT VALUATION & THE NAV MODEL

44Introduction to REIT Valuation & NAV17:47

45NAV Modeling, Part 14:00

46NAV Modeling, Part 221:29